Welcome to the Forex Sentiment Tool, a must-have resource for traders who want to stay ahead of market trends. By analyzing the sentiment of over 1 million global traders, this tool provides valuable insights into prevailing market views, helping you make smarter and more informed trading decisions. Whether you’re trading EUR/USD, gold, or exotic pairs, our Forex sentiment data ensures you stay on top of the market’s collective behavior.

Forex sentiment analysis is an essential strategy for traders at all levels. By understanding the collective behavior of traders, you can predict market movements, identify potential reversals, and make data-driven decisions. The Forex Sentiment Tool is particularly useful for spotting overbought and oversold conditions, helping you avoid risky trades and maximize profitability.

Unlike other trading tools, sentiment analysis offers a unique perspective on market psychology. Instead of solely relying on price action, this tool allows traders to understand the "why" behind market movements. It's not just about numbers; it's about insights that empower you to take calculated risks while avoiding common pitfalls. If you’re serious about achieving consistent trading success, Forex sentiment is your go-to resource.

Why Use a Forex Sentiment Tool?

The Forex Sentiment Tool is essential for understanding crowd behavior in the market. Here’s why:

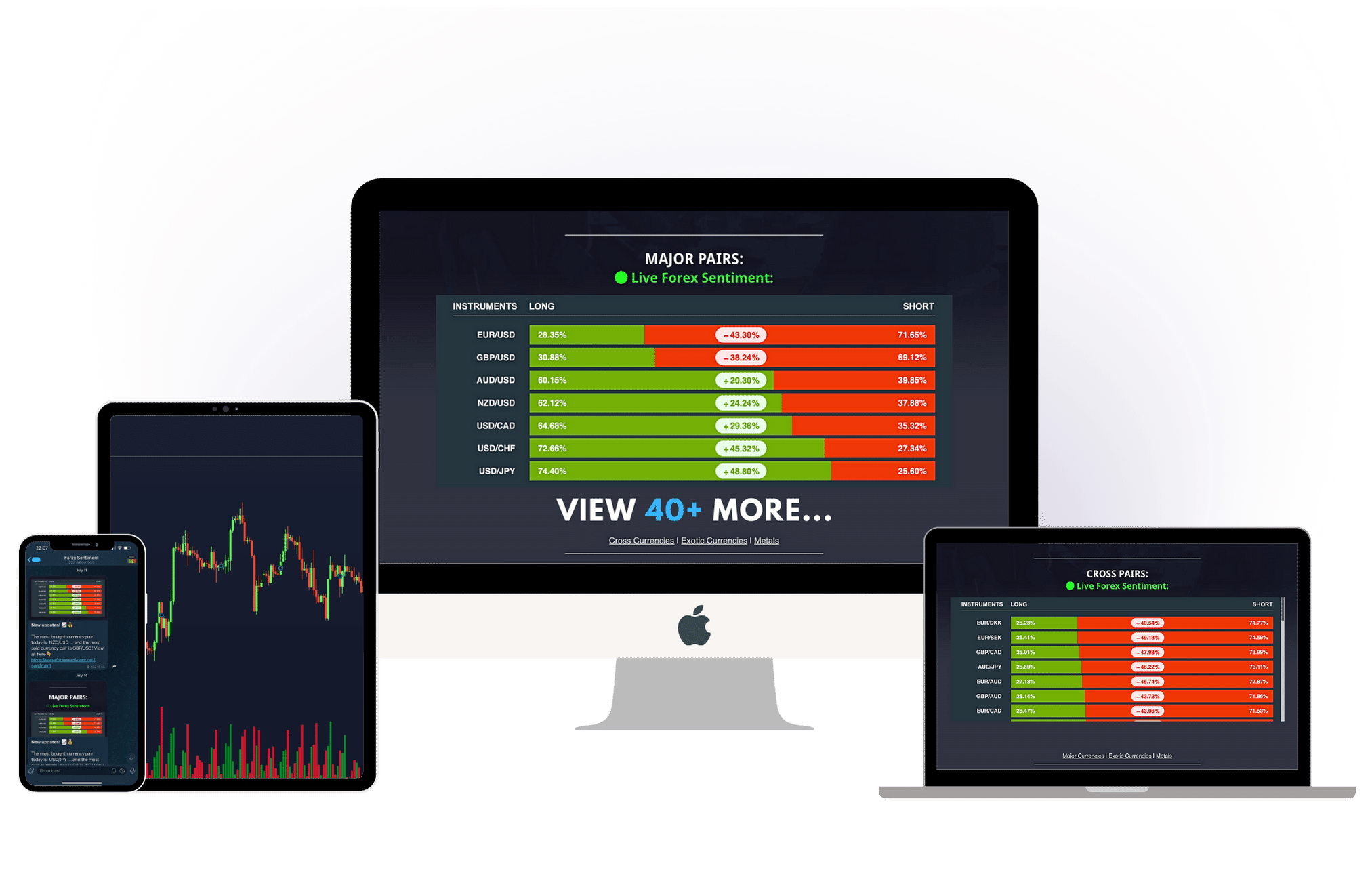

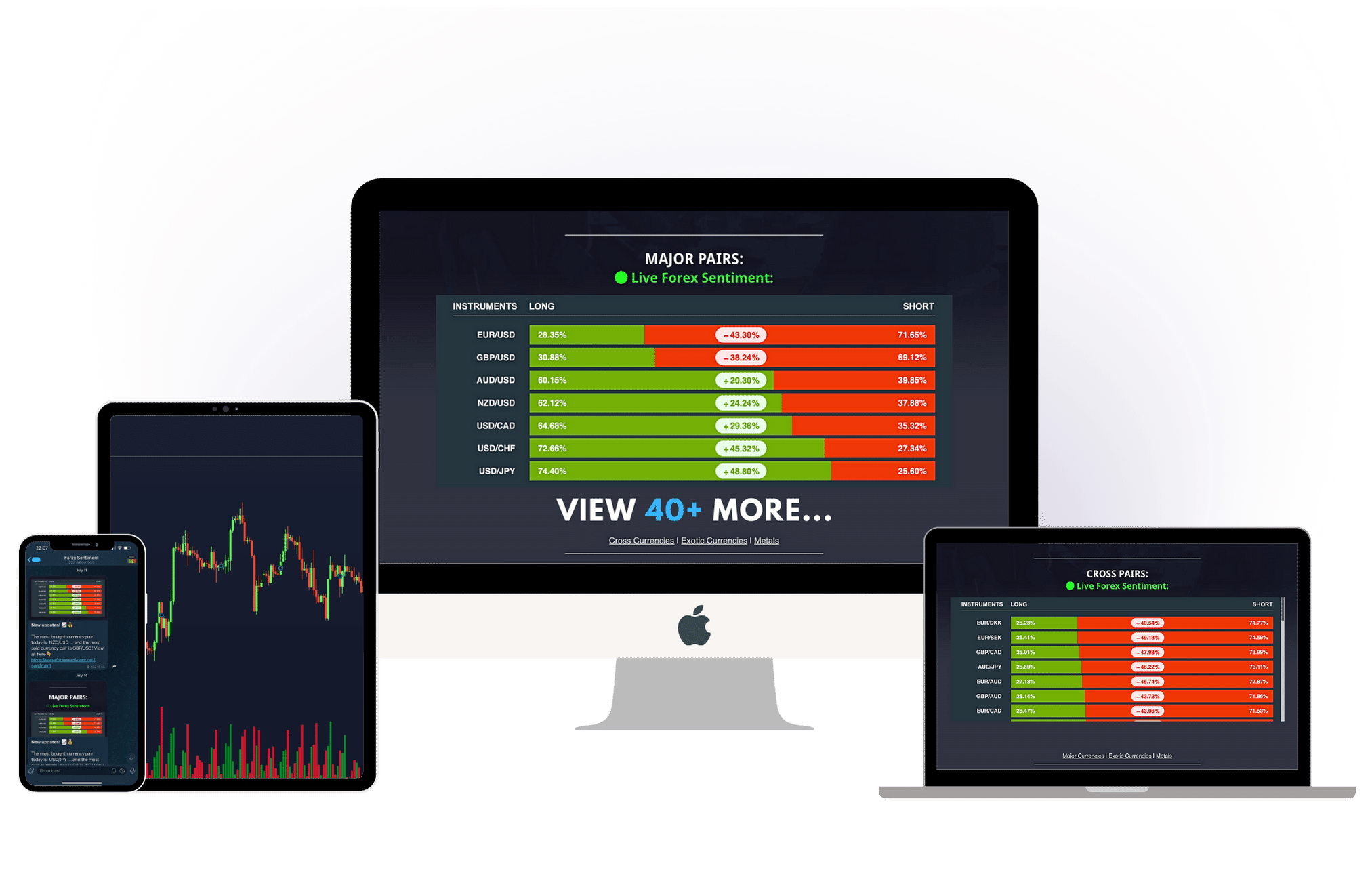

- Real-Time Data: Updated 24/7, giving you the most current market insights.

- Smarter Decisions: Use sentiment data as a contrarian indicator to capitalize on overbought or oversold conditions.

- Risk Management: Identify crowded trades and avoid high-risk setups influenced by market bias.

- Market Reversals: Extreme sentiment levels often signal potential reversals, helping you optimize entry and exit points.

- Market Insights: Gain an edge by aligning your strategies with global trader sentiment.

- Improved Timing: Sentiment data can help you refine your trade entry and exit points, improving your overall accuracy.

- Accessibility: This tool is free and easy to use, providing powerful insights without complicated setups.

How to Use Forex Sentiment: Step-by-Step Guide

To maximize the potential of sentiment analysis, follow these steps:

- Check sentiment levels on your target currency pair or asset.

- Identify extremes (e.g., 80% or more bullish/bearish) for potential reversals.

- Use contrarian strategies for extreme sentiment or align with the crowd in neutral markets.

- Combine sentiment data with technical analysis indicators like RSI or Bollinger Bands for greater accuracy.

- Set stop-loss and take-profit levels based on sentiment trends and price action.

- Regularly update your sentiment analysis to track shifts in crowd behavior.

Learn more in our detailed guide: How to Use Sentiment Analysis in Forex.

How Forex Sentiment Data is Collected

Our Forex Sentiment Tool aggregates data from global trading platforms, reflecting the percentage of traders holding long or short positions. If sentiment skews heavily in one direction, it can indicate overbought/oversold conditions or potential reversals. This real-time data empowers traders to act decisively and strategically.

Sentiment data is particularly effective when combined with other forms of analysis. For instance, if sentiment is heavily bullish but price action shows weakening momentum, it could indicate an upcoming reversal. Understanding how to interpret these signals can dramatically improve your trading results.

Real-World Example: Using Forex Sentiment for Smarter Trading

Suppose EUR/USD sentiment shows 85% of traders are buying. This strong bullish sentiment suggests the pair may be overbought. A contrarian trader might look for short opportunities, especially if technical indicators confirm a reversal. By leveraging sentiment data, you gain a clearer understanding of market dynamics. Explore this topic further in our resource: What is Sentiment Analysis in Forex.

Frequently Asked Questions (FAQs)

What is Forex Sentiment Analysis?

Forex sentiment analysis is the process of analyzing the collective sentiment of Forex traders to gauge market mood. By tracking how many traders are long vs. short on a currency pair, you can predict potential price movements based on crowd behavior. Sentiment analysis is a crucial tool for spotting overbought or oversold conditions and potential market reversals.

How can I use sentiment analysis to identify trends?

Sentiment analysis can help confirm or invalidate a trend. If sentiment remains overwhelmingly bullish or bearish for a currency pair, it indicates that the trend is likely to continue. However, if sentiment begins to shift significantly, it could signal the end of the trend or a potential reversal. By monitoring sentiment regularly, traders can adjust their positions accordingly.

Can sentiment analysis help me predict market reversals?

Yes, extreme sentiment levels—either too bullish or too bearish—often precede market reversals. If 80% of traders are bullish, it could indicate that the pair is overbought, and a reversal is likely. By using sentiment data alongside technical analysis indicators (like RSI or MACD), you can gain more confidence in spotting potential reversal points.

How to Leverage Forex Sentiment in Specific Market Scenarios

Forex sentiment analysis isn’t just useful for general market trends; it can also be extremely helpful in specific trading scenarios. Here are some examples:

1. Identifying Overbought and Oversold Conditions

When sentiment is heavily skewed towards one direction, it often indicates potential overbought or oversold conditions. For example, if 85% of traders are long on a particular pair, it might signal that the pair is overbought, and a reversal could be imminent. This information allows traders to avoid buying at the top and helps them spot when the market might be due for a correction.

2. Spotting Market Reversals After Major News Events

Sentiment analysis is especially useful after significant news events. Often, the market initially reacts to news in one direction before reversing. By tracking sentiment before and after such events, you can identify shifts in market sentiment and position yourself ahead of the curve.

3. Trading During Volatile Market Conditions

During periods of high volatility, sentiment can change rapidly. By monitoring sentiment closely, you can identify when the crowd is overly fearful or overly confident, allowing you to make strategic trades that capitalize on emotional swings.

Case Studies: Real-Life Applications of Forex Sentiment

Let’s explore a few case studies to see how Forex sentiment has been used in real trading scenarios:

Case Study 1: EUR/USD During a High Volatility Period

In a period of heightened volatility following a major news event, EUR/USD sentiment was overwhelmingly bullish, with over 80% of traders going long. However, technical indicators suggested weakening momentum. This combination of sentiment and technical analysis helped a contrarian trader identify a reversal opportunity and profit from a sharp drop in EUR/USD.

Case Study 2: GBP/USD Following a Brexit Announcement

During the Brexit referendum, sentiment for GBP/USD became heavily bearish. While many traders expected a further decline, sentiment data indicated that fear had driven prices too low. A contrarian trader took advantage of this extreme sentiment and saw significant gains as the GBP/USD recovered in the days following the announcement.

Advanced Applications of Forex Sentiment

Experienced traders often use sentiment data to refine their strategies further. Here are some advanced techniques:

- Layering Trades: Combine sentiment extremes with volume data to time entries more precisely.

- Identifying Liquidity Zones: Use sentiment to predict where stop-loss clusters might exist, providing opportunities for smart entries.

- Scaling Positions: Add to positions as sentiment trends align with your overall strategy.

- Contrarian Confirmation: When sentiment data aligns with reversal patterns, it offers a robust confirmation for contrarian setups.

- Tracking Momentum: Monitor sentiment changes alongside moving averages to identify emerging trends.

Best Practices for Forex Sentiment Analysis

- Identify Extremes: Sentiment at 80% or more often signals a reversal opportunity.

- Combine with Technicals: Use RSI, MACD, or Fibonacci retracements to validate sentiment signals.

- Monitor Regularly: Sentiment shifts can occur rapidly, especially during news events or high volatility.

- Stay Flexible: Sentiment is a dynamic metric, so adapt your strategies as market conditions evolve.

- Backtest Strategies: Before implementing sentiment-based strategies, ensure they align with historical performance.

- Leverage Sentiment History: Analyze historical sentiment trends to identify repeating patterns in market behavior.

What Traders Say About Our Sentiment Tool

"This tool has improved my trading strategies by helping me identify crowded trades and avoid common traps." – Alex, Sydney

"Forex sentiment analysis helped me spot reversals before they happened. A game-changer for my trading!" – Sara, London

"Understanding market sentiment is a crucial part of my trading strategy now. This tool made it easy!" – John, New York

Access Live Forex Sentiment Data Now

Don’t trade blindly. Start using our Forex Sentiment Tool to understand market behavior, identify opportunities, and make more informed decisions. Bookmark this page for real-time insights and maximize your trading potential.